Background

On October 30, the US Central Bank announced that it will cut down the interest rate to a target range of between 1.5% to 1.75%. This is the third cut this year, following an earlier reduction in July, which was the first reduction in the interest rate since 2008. The Central Bank decided again to implement a second, and now a third, reduction after short intervals.

When the interest rate is reduced, the cost of borrowing decreases. As a result, firms and households are encouraged to borrow more and invest in more assets which stimulates the economy. Hence, a reduction in the interest rate happens when the country needs to expand its economy or to prevent its growth rate from falling.

Currently, the US economy is maintaining its GDP annual growth rate at around 2% which is within the healthy rate of growth, 2% to 3%. Nonetheless, the central bank chose to reduce the interest rate further. Jerome H. Powell, the Fed chair, explains that one of the reasons why the US economy is remaining strong with a low unemployment rate is because of the previous interest rate cuts and an additional cut will help to secure the growth rate against the threat caused by the US-China trade war.

Rising risk in the global economy

One of the two main factors contributing to the uncertainty in the global market are the low global interest rate and the negative impact of the US-China trade war on business confidence and investment. Several key economic players around the globe, especially Japan and the European Central Bank, have negative interest rates. The US’s 2% interest rate range is relatively high compared with these countries and as the US president Donald Trump continuously tweets, the high-interest rate of the US is contributing to the comparative disadvantage of the US goods relative to those countries with low-interest rates. However, as more the US central bank reduces its interest rate, the action may produce impressions that the US economy is facing a recession.

The US is still the world’s wealthiest and strongest economic player, which investors tend to view as a reliable nation in which to invest. Hence, the US central bank is working to hold the current positive perceptions of the investors so their flow of investment and money circulation will not be disturbed. However, if the central bank continues to reduce its interest rate, the rate will eventually reach 0 where lowering the interest rate no longer becomes an effective method to avoid recession. When a recession occurs domestically with the US central bank holding a close to 0% target interest rate, this could precipitate another global recession.

The second main factor of global risk is the escalating tension and exchange of import tariffs between the US and China. In early September, the Trump administration imposed 15% taxes on US $112 billion of Chinese imports, resulting in more than two-thirds of the imported consumer goods from China facing higher prices. In response, China started to raise tariffs on US $75 billion of US imports. Their exchange of increased tariffs is expected to contribute to a slowdown of the global growth and lower demand for investment by foreign investors to both countries. This has a great impact on the world economy because those countries are the first and the second strongest economies, with the largest amount of trade volume in the world.

Also, the overwhelming debts owned by the US government – and the world – escalates the risk of financial crisis. Global debt in 2019 is US $246.5 trillion, including an additional US $3 trillion from the first quarter. The high proportion of debt relative to its GDP in the US may suggest that when the country encounters a financial crisis, fewer countries will be willing to lend funds to help America dig its way out.

Impact on Canadian Economy and Indication of Financial Crisis

For Canada, the US is both an important export market for Canadian goods and a key player in the financial markets by affecting exchange rates, interest rates, and international flows of investment funds. Unsurprisingly this additional interest rate cut is expected to affect the Canadian market to a significant degree.

Canada’s growth is around 1.5% and inflation is around 2%, which the Bank of Canada is hoping to maintain. However, the US Fed will likely invoke the Bank of Canada to lower its interest rates significantly in the coming weeks to stimulate economic activity. The effect of America’s moves will not have an immediate impact on Canada but will strengthen the likelihood that the Bank of Canada will decrease its interest rate in response.

If the US interest rate drops further, say close to 0%, US goods will have a significantly stronger comparative advantage against Canadian goods and because the US is Canada’s biggest trading partner, Canadian may lose a great number of exports. Therefore, Canada will likely lower its interest rate close to 0% to remain competitive. This will more likely lead Canada to a recession where Canada, as well as the US, will be unable to recover by further lowering the interest rate.

If Canada’s interest rate declines, mortgage rates will decline further. This will allow easier qualifications for first-time home buyers. However, cheaper mortgages may also stimulate housing sales and prices, exacerbating the already high price in real estate of the Greater Toronto Area and Vancouver, making it harder for average income earning citizens to own a house.

The natural outcome of market expansion by lowering the interest rate can be weakened if commercial banks do not cooperate. In 2015, the Canadian central bank reduced its interest rate by 0.25% expecting the commercial banks to fully incorporate the reduction to their prime rate. However, the commercial banks decided to reduce the rate by 0.15%. When a commercial bank implies only a portion of an interest rate cut, borrowers face a higher rate than the central bank anticipated so less borrowing occurs. This leads to smaller expansion of the economy, hence pressures the central bank to lower its rate further.

Another factor that pressures the Bank of Canada to reduce its interest rate is the tension escalating between the US-China trade war. Karnye B. Charbonneau, Analysist in Bank of Canada, published an analytical note on predicting the impacts of the set of tariffs and forecasting future developments through the Charbonneau-Laundry trade model (CLTM). He expects the trade war will have a direct effect via the trade cost and an indirect effect through the input bundles. Higher trading and production cost will lower both the sales and prices of Canadian-sold commodities, leading to lower Canadian GDP and higher prices.

In addition, the amount of Canadian government debt is reaching its peak. Government debt in Canada reached an all-time high of 671.25 CAD billion in 2018 and continues to grow. As well as the US, Canada will be placed in a worse position to recover from financial crisis, if it arrives, if government debt remains higher than ever. Historically economic crisis in the US almost always impacts the Canadian economy due to our interrelated relationship; thus if the US is under threat of financial crisis, Canada will be too.

An analysis of the US yield curve by Campbell Harvey, a professor in Duke University, supports the suggestion that the US is heading to recession. Two weeks ago Campbell Harvey flashed concern for recession suggested by the inverted yield curve of the US economy. A yield curve plots bond yields with equal quality but different maturity dates. An inverted yield curve means a much lower interest rate is expected in the future. Also, the downslope indicates the economy is in recession. The Canadian yield curve exhibits an identical trend. The last 6 months of the Canadian yield curve are inverted. This implies investors are more likely to invest in long-term maturity bonds rather than short-term to take advantage of the current bond yield.

Alternatives to Stimulate the Economy without Increasing the Interest Rate

The Canadian government needs to implement an effective stimulus plan that provides incentives for future spending. One possible suggestion is tax cuts, which increase the disposable income of the common household, thus encouraging the demand for consumption. Particularly, the reduction of the tax rate to the upper-income class will most likely stimulate the economy since they are the main contributors to investment. However, with such policy, the issue of wealth inequality will rise and may worsen the living circumstance of lower and mid-income households. Therefore, if the tax cut policy is to be implemented, it should include a specific compensation plan for the lower mid-income households that can address those concerns.

In addition, both investment opportunities and investment confidence need to be increased to bolster the economy. Advancement in technology is one of the main attributes of the economy’s growth rate. Montreal holds the highest concentration of researchers in deep learning and Toronto has the highest concentration of Artificial Intelligence (AI) start-ups in the world. Development in this field will most likely lead to new inventions and technology accompanied by more investment opportunities. As the high-tech sector is growing significantly, the government should continue to support and assist the development of these industries and infrastructure.

Conclusion

The recent interest rate cut by the US central bank is understood as an action to secure the current economic growth and inflation rate from the negative impact of the US-China trade war. However, this contributes to the lower global interest rate and increased global debt. The impact of the interest cut on the Canadian economy is still small, but several indications such as Canadian government debt and an inverted yield curve suggest that Canada is at risk of a financial crisis. Lowering the interest rate further should be avoided to reduce Canada’s risk of defaulting. Possible solutions to these issues are a reduction in domestic tax rates and the promotion of new technologies in the fields of Artificial Intelligence and deep learning, where Canadians currently hold a competitive advantage.

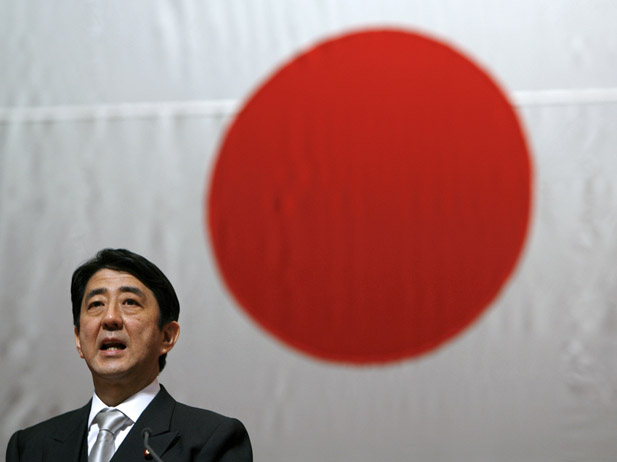

Photo: Bank of Canada, by Wladyslaw via Wikimedia Commons. Licensed under GNU Free Documentation

Disclaimer: Any views or opinions expressed in articles are solely those of the authors and do not necessarily represent the views of the NATO Association of Canada.