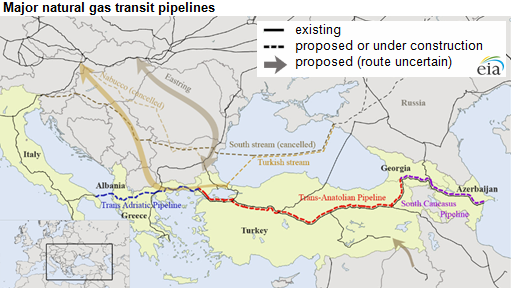

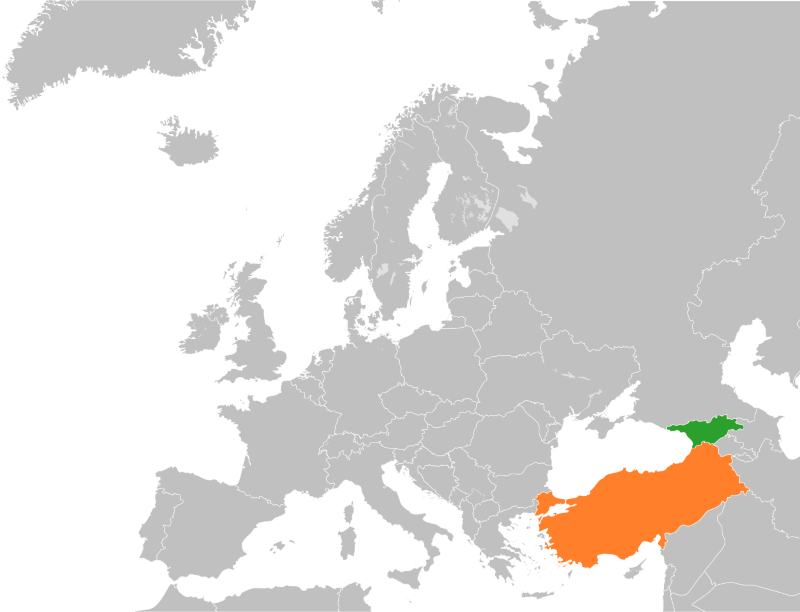

As the EU seeks to diversify its sources for energy imports, Azerbaijan will likely reap important benefits. The significant question is how rapidly it can ramp up its exports via the Southern Gas Corridor (SGC). Exports by way of the SGC go through Georgia (via the South Caucasus Pipeline, SCP), then across Turkey from east to west (via the Trans-Anatolian Natural Gas Pipeline, TANAP), then across Greece and under the Adriatic Sea to Italy (via the Trans-Adriatic Pipeline, TAP).

According to Azerbaijan’s president, Ilham Aliyev, his country exported 19 billion cubic metres (bcm) of gas in 2021, of which 8.5 bcm went to Turkey. What did not go to Turkey or Italy, went to Bulgaria, Georgia, and Greece. Earlier this month Kadri Simson, the EU’s energy commissioner, told a news conference in Baku, during the meeting annual ministerial of the SGC Advisory Council, that the EU hoped the TAP would increase its annual volume from 8 to its maximum 10 bcm per year (bcm/y).

Clearly, this is insufficient for Europe at large. In fact, of the 8 bcm of gas from Azerbaijan into Europe last year, only 7 bcm was carried into Italy. Moreover, this is only a small fraction of the 169 bcm/y that the EU imports from Russia. The chief of TANAP has announced that Azerbaijan would this year ship 16.2 bcm via TANAP, implying deliveries of 10.5 bcm to Europe. TANAP, he said, “is operating at 100% of its capacity” and 5.7 bcm/y of the total goes to Turkey itself.

The 16.2 bcm/y is indeed the current capacity. At the time of construction, plans were made to ramp up throughput in stages, first to 23 bcm and later to 31 bcm. This can be done without building another pipeline, but it would take four or five years to construct the necessary infrastructure.

Azerbaijan’s proven natural gas reserves amount to 2.6 trillion cubic metres (Tcm), of which the offshore Shah Deniz development is the largest at 1 Tcm. Commissioner Simson adumbrated “the question of [the SGC’s] its next stage, and whether the corridor can be expanded in its capacity or even extended geographically [across the Caspian Sea to Central Asia].” This sentence adumbrates the Trans-Caspian Gas Pipeline (TCGP) project, on which unfortunately little progress has been made since it was first proposed many years ago.

Azerbaijan’s offshore Absheron field will begin production this year or next with the modest quantity of 1.5 bcm/y, which will increase in steps over time. Other known fields are open for development, such as Babek with estimated reserves of 400 bcm and Umid with at least 300 bcm. There is also a potentially very fruitful “deep gas” section of the older oil and gas field Azeri-Chirag-Guneshli field.

Also Ukraine could, in theory, receive gas from Baku. The gas would transit Turkey from east to west, then enter the Trans-Balkan Pipeline and by “reverse flow” reach Ukraine via Greece, Bulgaria, and Romania. This is the pipeline that until relatively recently had transited Russian gas through Ukraine to western Turkey.

Azerbaijan is increasing electricity generation from renewable energy sources and hopes to use the natural gas that they replace for additional European exports. Azerbaijan and Saudi Arabia, for example, recently started construction of a $300 million wind-power project north of Baku. Discussions are also under way with Qatar for the construction of wind-power plants in the Lachin and Kalbajar districts of Karabakh.

Key sources of renewable energy in Azerbaijan are biomass, geothermal, hydropower, solar and wind energy. The potential for solar and wind power generation is especially significant. Azerbaijan’s energy ministry has already prepared a concept for developing “green energy” in Karabakh and East Zangezur provinces. They assess approximately a 7,200-megawatt (MW) potential in wind energy and another 2,000-MW potential in solar energy. These developments could also be put to use for exporting electricity. The potential for wind power is also favourable on the Absheron Peninsula and for certain islands. The full technical potential of the Caspian Sea region is this regard is assessed at more than 150,000 MW.

Türkiye (to which Turkey recently changed its official name in the English language) is indicated to be a major market for electricity exports. The idea of constructing electricity transmission lines under the Black Sea to Europe has even been discussed. This requires electrical-grid modernization in Azerbaijan, which is also under way.

At least as notable as the declarations on energy at the SGC Advisory Council earlier this month was the announcement by EU Commissioner for Neighbourhood and Enlargement Oliver Varhelyi that a package of €2 billion was being allocated to Azerbaijan for economic investment plan. In the past, the EU had failed to recognize, in its new investment plan for Eastern Partnership countries, the costs that Azerbaijan must bear for demining and reconstruction of the previously occupied territories. Indeed it was learned in July 2021 that Azerbaijan was scheduled to receive only €140 million, whereas Georgia was planned for €3.9 billion, and Armenia for €2.6 billion.

The allocation to Armenia seemed especially inappropriate, despite its need, because it looked like a reward for having occupied Azerbaijani territories for 30 years before being ejected. Now, however, the EU has also stated its readiness to participate in the reconstruction process. This would appear to be a major policy shift by the EU. Indeed, if it is implemented as planned, then the EU’s potential for mediation in the region will be better realized, with important geopolitical implications, since until now such mediation has been conducted mainly, indeed exclusively, by Russia. Energy cooperation between the EU and Azerbaijan will surely play an important role in motivating and realizing further developments.

Image copyright: Major Natural Gas Transit Pipelines [Caucasus and Southern Europe], by U.S. Energy Information administration and IHS EDIN via eia.gov. As a work of an agency of the United States Government this work is in the public domain.

Disclaimer: Any views or opinions expressed in articles are solely those of the authors and do not necessarily represent the views of the NATO Association of Canada.