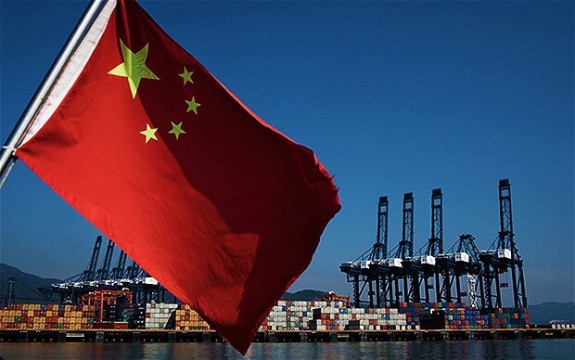

Starting with three articles on Rare Earth Elements(REEs), the Critical Defence Minerals series will examine the raw resources and components used in the creation of modern military equipment. The series will begin with the REEs because the centralization of their supply, their lack of substitutability, and the combined industrial and military applications that render them extremely important. Most of the global REE production used to be sourced within NATO member states, with the United States producing the majority of global supplies until the mid 1980s. China now supplies 95% of REEs globally, and has hinted at possible strategic hoarding of these critical minerals. The Critical Defence Minerals series examines the potential security implications of disruptions.

The first part of this series analyzed the centralization of REE supply, their usages, and recent U.S. domestic legislation regarding issues in their supply. This part of the series will focus on the international community’s reaction to illegal export restrictions of REEs that China began in 2012. The General Agreement on Tariffs and Trade(GATT) is the most relevant international agreement to these restrictions, and is well cited in World Trade Organization(WTO) law-suits addressing China’s export manipulation.

Until recently, the Molycorp Mountain Pass REE mine offered an alternative supply in North America. MolyCorp has fallen from a $6 billion USD evaluation five years ago to declaring bankruptcy earlier this year, leaving the future state of REE production outside of China in an uncertain state. The MolyCorp mine operated at a loss for several years before being shut-down in August 2015. China controls global REE prices, and dictated low prices during these years, making the operation economically unfeasible. One example is europium, which dropped from $3800/kg in 2011, to $225/kg in 2014. This is significant because it has heightened the importance of strategic trade partners such as China to NATO member states. Alternatively, it suggests that there is a strong argument in favour of government support for domestic REE production.

In 2014, the United States, Canada, Japan, and the European Union sued China in the World Trade Organization(WTO), largely due to China’s illegal restriction of REE, tungsten, and molybdenum exports in 2012. An interesting aspect of the proceedings was that after the U.S. initiated the case, Canada, Japan, and the European Union requested to join in the consultation with the WTO. This is an indication that there is a combined concern on REEs in the international community spanning both NATO and non-NATO member states. Several articles in the GATT are cited in the legal proceedings, ranging from issues in fees connected with importation and exportation, administration of trade regulations, and the general elimination of quantitative restrictions.

In essence, China established quotas, which breaches a core tenant of the GATT stating that duties and taxes may only be imposed as a restriction, as opposed to arbritrarily limiting an export. For the most part, China did not appeal the findings of the WTO panel, only questioning certain intermediate findings and reasoning. As a result of the WTO proceedings, China agreed to resolve the export inconsistencies. In May 2015, the U.S. and China agreed that China had returned to compliance with the GATT. This has lead to a return in Chinese REE exports, however the concerns regarding their supply remain.

In the case of this centralized production of REEs, conflicting security interests have the capacity to spill-over into long-standing trade relationships. China has the ability to cut 95% of global supplies of these 17 critical minerals. China has shown a past disregard for long-standing trade agreements, leading to a degree of uncertainty regarding China’s commitment to fulfill export obligations. There is a possibility that China could return to REE export quota strategies. In turn, this has the potential to cripple the ability of NATO member states to manufacture a wide variety of modern military technologies required for national defence.