Many members of the North Atlantic Treaty Organization [NATO] are also members of the European Monetary Union [EMU]. This article will take a look at an often overlooked block of European Union economies, the Growth and Stability Pact (GSP).

What is it?

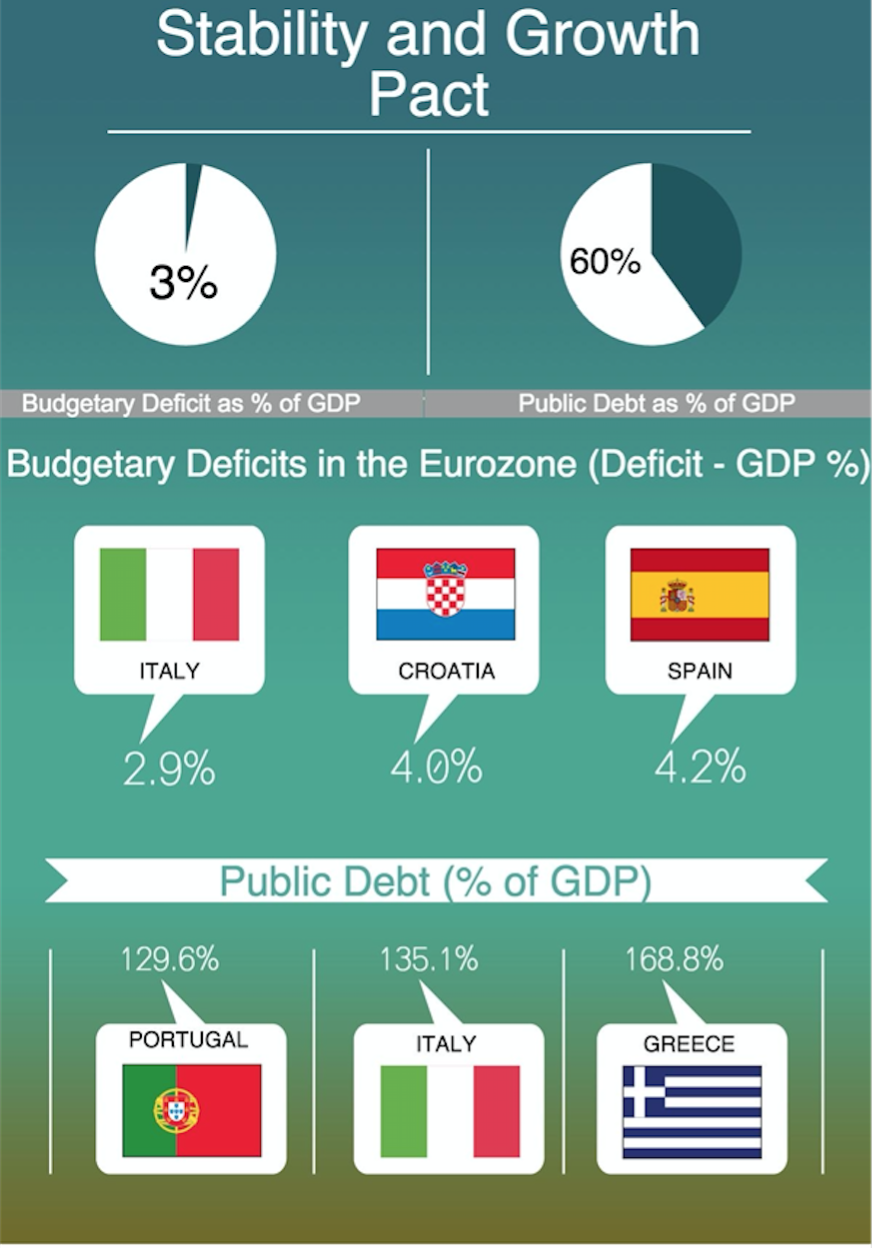

Simply put, the Growth and Stability Pact (GSP) is an agreement to commit, facilitate and maintain the continued stability of the European Economic Union (EMU). Created to ensure fiscal discipline would be maintained within the EMU, the Stability Pact asks governments to commit to reasonable budgetary and debt ceilings. It is essentially a mechanism which all 28-member states of the European Union (EU) agree to comply with in order to pre-emptively stop spikes, or severe imbalances, in areas of inter-area inflation, public debt and budgetary deficits. Specifically, the GSP asks that member governments limit their budgetary deficit to 3% of their Gross Domestic Product (GDP), and to keep public debt burdens under 60%.

Criticisms

The Growth and Stability Pact is not, however, without its faults. The GSP has come under frequent attack from a variety of authorities since its implementation in 1997. Firstly, and one of the most frequent attacks levied against the Pact, comes from the member states themselves. They argue that, especially in times of recession, limiting government spending may hamper economic growth, job creation and ultimately prolong the nation’s economic recovery. On the other hand, the GSP has also been criticized for being too lenient. Economist Antonio Martino claims, “ Creative accounting [is] used by many countries to achieve the required deficit to GDP ratio of 3%, and by the immediate abandonment of fiscal prudence by some countries once they are admitted into the Euro club.” Many European states have failed to keep within GSP limits, prompting criticism from their EMU partners.

A third, and final, criticism of the GSP centers on its enforceability. Larger economies have been able to use the procedures, and flexibility of the European Commission [EC] to bypass punishment by the GSP. By definition, both France and Germany violated GSP ceilings from 2003-2005. Both economies stagnated and both governments did not keep budgetary deficits under the required 3%. No fines where levied by the EC, which came under intense pressure from both Paris and Berlin to provide their respective governments time to restructure, and curb, their deficits. Smaller countries, who at the time, adhered closer to the EMU rules on inflation control, wage coordination and capping public spending accused the GSP of having ‘double standards’ or a two-track Europe: one set of rules for periphery economies and one for major economies.

Why is it important?

At first glance, it may seem that the Stability Pact is simply a structural accord imposed by technocrats in Brussels for the benefit of the central monetary authority of the Union. This is not completely true. The GSP has a direct and significant impact upon both the domestic economies of the Eurozone as well as the macro-economic and fiscal policy of the EMU. Most recently, the Spanish administration of President Mariano Rajoy has been ‘rapped across the knuckles’ for operating outside the limits of the GSP. With a projected budgetary deficit of 4.5% of GDP in 2015, the Spanish government has attracted the ire of Brussels for blatantly circumventing the limits and parameters of the GSP. It remains to be seen, however, if Brussels will impose any strict sanctions, or if it will acquiesce to Madrid’s budgetary program.

In another hit to the credibility of the GSP, Eurozone economies Ireland, Italy and Greece have all formally requested for more ‘budgetary flexibility’ in order to meet the ‘exceptional, and extraordinary circumstances’ caused by the influx of refugees into their respective countries. The massive economic strain of the migrant crisis has forced many economies to re-address their original budgetary projections. Given the importance and sensitivity of this issue it would seem unlikely that these countries will be chastised or punished under this extraordinary circumstance.

With the emergence of the European Debt Crisis in 2010, and subsequent economic difficulties encountered across the continent today, the Growth and Stability Pact continues to play a central role in the economic structure, future and stability of the both the European Monetary Union, and domestic economies of Europe. The basic premise of the pact makes sense. It would have been impossible or unimaginable to coordinate the accession of 12 individual economies without structural procedures limiting the monetary discrepancies between would-be members. Promoting financial stability among economies of varying public debt levels, budgetary deficits and domestic inflation was, likewise, an economic necessity when the political union failed to materialize. Stronger enforceability with regard to budgetary deficits, and more concerted efforts at reducing public debt must be made by the members of the European Monetary Union in order for the Growth and Stability Pact to be an effective regulatory body.