The fundamental building blocks of society are often characterized by a model made of a supplier, a supply chain, and a consumer. Yet, with technological evolution, the traditional model of order has been repeatedly challenged and uprooted. Blockchain technology’s very purpose seeks to remove the ‘middle-man’ from all processes. The nature of this technology has been referred to as “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way”. Simply speaking, it allows for transparent and efficient processes between two parties to be executed, taking a decentralized approach to all societal transactions.

First off: What is blockchain technology?

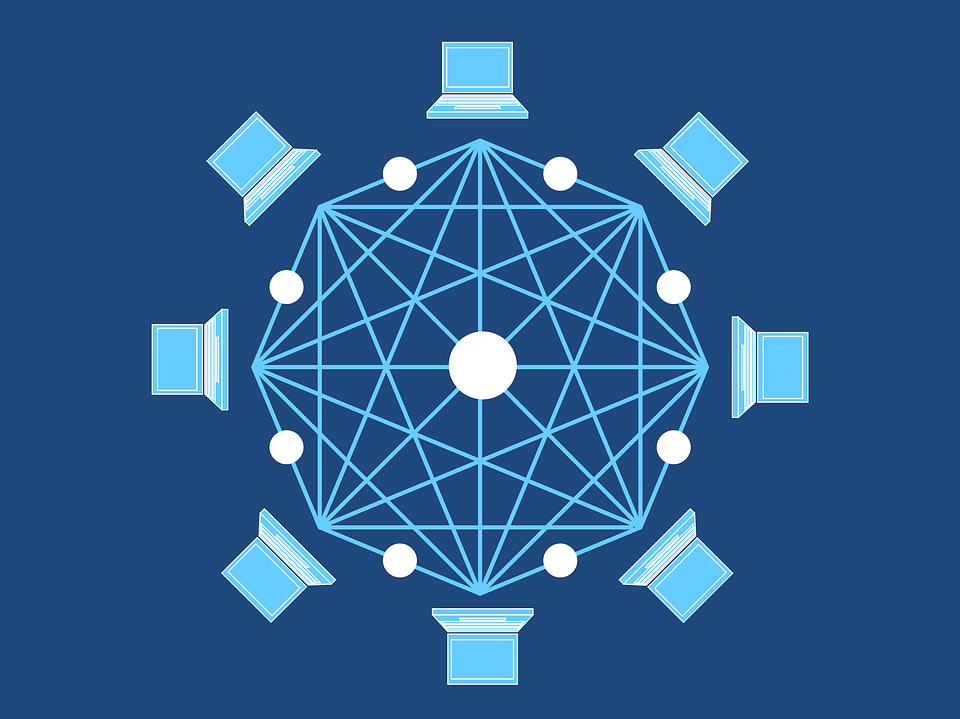

To visualize blockchain technology, it is taken quite simply as blocks connected into a chain. Connected to each block is a growing list of records which are linked using cryptography, and each unit has an individualized timestamp and transaction data. In this way, because the blocks are ‘built’ on top of one another in accumulation, the blockchain is resistant to data modification. If one block is to be altered, the blocks prior to and following will consequently be affected.

Once a transaction is requested, this request adds a block of data to the ledger, changing it permanently and rendering it unalterable. Not only is the foundation of this technology grounded in its unshakeable form, but it allows every individual who participates in the transaction to be held accountable to their actions due to this transparency.

What are the implications of this technology?

A Look into Facebook:

Looking toward 2020, Facebook has announced its plan to launch a digital coin, using blockchain technology to make sending money to friends and family as simple as sending a photo. Facebook is not the only company with plans for digital currency – other companies such as Signal and Telegram also have similar ideas. Although the transition into digital currency has been gradual and somewhat normalized, the decentralized foundation of blockchain technology will likely lose its hype with Facebook, as there is no single individual in charge of the currency. Whereas Facebook has often preferred to be in control of relevant data, blockchain’s nature does not allow for this ownership. Moreover, the fundamental traits of the technology like transparency and individual ownership may be compromised with the use of strict rules, possible capped transfers, and policed monetary flows across borders, due to fears of money laundering and criminal activity.

The implications of this innovation have potential both for greatness and disruption, with the ability to change business models which could ultimately have serious impacts on entire industries.

Blockchain on the Stock Exchange:

Stock exchanges are processes which require tumultuous coordinated actions to allow payment, delivery, and reconciling records. Due to the timely nature of these processes, blockchain offers the potential of an efficient and sped up system, if stock exchanges are to adopt this technology. Yet, the element of transparency haunts the stock exchanges just as much as it does Facebook. While Australia, Switzerland, Singapore, and America are in their early stages of contemplating blockchain, many only desire the speed and efficiency, but not the transparent aspect. Focusing specifically on Australia (ASX), the terms the stock exchange has set out require for a continually centralized system needing the approval of participants, with only bankers and brokers are able to opt for direct access. These conditions create an aura of exclusivity that blockchain’s very nature is designed to counter. Hence, any new implementations proposed by technology stock exchanges choose to move forward with, will require much contemplation and compromise; perhaps the use of blockchain is not meant for the world of stock exchange.

Blockchain and Electrical Energy:

Looking at the transactional structures that are subject to change in the electricity sector in the European Union, much of the energy transition is currently led by the mentality of a ‘consumer centered’ direction. With this in mind, the role of the consumer in these energy transactions is sure to change with blockchain, as digital currency would eliminate the need for third parties, suppliers, and system operators. The traditional centralized governing system for electrical energy had clear cut legal and policy boundaries, but with the decentralization of power invited by blockchain, these legal and policy consequences would be rendered unclear.

As the current law is based on the actors of the supply chain and their responsibilities accordingly, all these roles would be redefined and some will be eliminated completely. This decentralization will alter the consumers’ role into one of a ‘system user’, each with the responsibility to engage in transactions. All in all, the current top-down legal framework of the EU’s electricity sector would transform, with blockchain, into one that instead works from the bottom-up.

Preparatory Steps to Welcome Blockchain:

On the legal aspects of blockchain technology, Usha Rodriguez offers her take using the comparison of contract law, and the current hardship in uncovering where the law can fit in with blockchain. She defines contract law as a mechanism that fills in where “humans unwittingly leave in consensual dealings”. As blockchain does not have those gaps due to its technological and logical nature, there is no specific ‘legal intervention point’, making the ability to regulate the technology harder by tenfold. The confusion and continual search for the role of law attributed to the technological world and its varying innovations is one that is not only limited to blockchain, but also other up-and-coming technologies.

Rodriguez offers a solution in the end, suggesting that due to the lack of entry point on the code itself, as long as there are identifiable individuals who are able to take responsibility for their transaction, this becomes the only gap between the blockchain and the corporeal world. Essentially, this would place the onus and the weight of the law on the individual, rather than directly governing the technology itself.

There are many uncertainties that can come with new innovation, but with these unknowns also come an abundance of potential to further all societal processes. As seen through these diverse platforms including Facebook, the stock exchanges, and the EU’s electrical energy systems, blockchain’s appeal to the market is one that cannot be hidden and thus must be well-regulated. The best way to approach these upcoming changes would be for the continual education of all potential users, including the general public, cyber experts, multinational corporations, and governing bodies, all of whom should be well versed in understanding the changing technological processes. Furthermore, thorough communication must be instilled between governing bodies and cyber experts, in order for all to be well-armed with proper precautions against the misuse or abuse of the data that renders the blockchain functional. The twenty-first century cannot afford to have a lapse of communication between those who know the technology well and those in charge of implementing any necessary regulatory or legal measures.

Featured Image: Blockchain (2017), by Tumisu via Pixabay. Public Domain.

Disclaimer: Any views or opinions expressed in articles are solely those of the authorsand do not necessarily represent the views of the NATO Association of Canada.