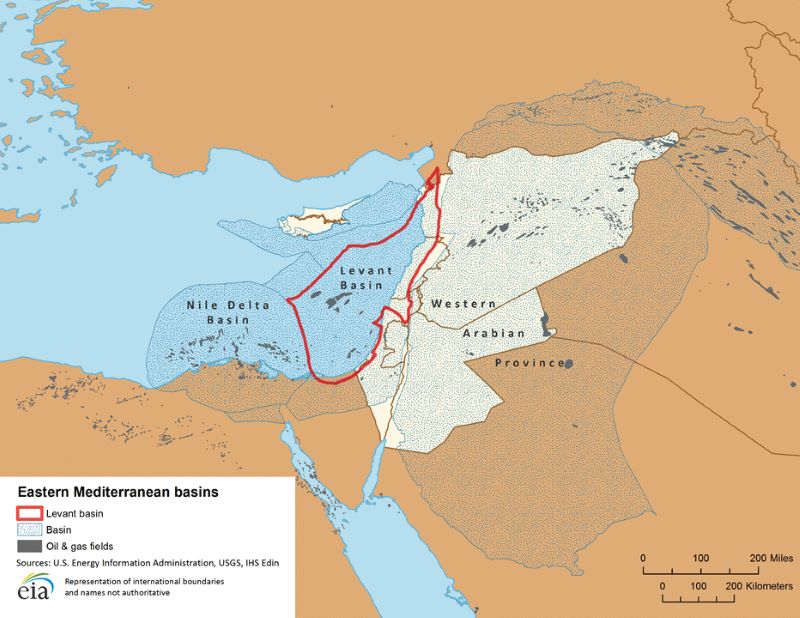

Attempts to commercialize the East Mediterranean natural gas province continue still with difficulty. The gas deposits in the Cyprus offshore continue to be at the centre of attention, while those of Israel and Egypt are set in relation to those.

The issue that preoccupies observers is how to market the gas from Cyprus in Europe. Until now, the Aphrodite strike has been correctly judged to be too small to justify its development alone. Originally, it was thought possible to develop it together with some Israeli offshore gas and transmit it to Cyprus for insertion into the projected EastMed pipeline (arriving in mainland Greece via Crete).

Discussions about this project are still going forward, also in the context of its extension into the so-called CrossMed pipeline, which would include the Poseidon pipeline (sometimes called the Interconnector Greece-Italy) under the Ionian Sea. However, in the current international commercial environment, neither of these variants is cost-effective or competitive, despite public claims to the contrary by the principals and despite an expressed interest by the European Union (which costs little to Brussels).

A newer development is the report of Shell’s negotiations to buy gas from both Cyprus’s Aphrodite deposit and Israel’s Leviathan deposit, a total of 10 billion cubic metres per year (bcm/y) together, and take them by pipeline, by means yet to be identified (there are three possibilities) to its EDCO natural gas liquefaction plant in Egypt, enabling exports not just to Europe but to the world at large.

The three possibilities are to use the old Arish-Ashkelon pipeline of the East Mediterranean Gas Company, to transit it through Jordan, or to build a new pipeline. They all assume the absence of geopolitical obstacles, which have however only increased in recent weeks and months. Egypt’s prime minister recently expressed an openness to the route through Jordan. However, a maritime pipeline directly from Cyprus to Egypt has also been under discussion since last year.

ExxonMobil has meanwhile sought to explore other offshore blocks of Cyprus, opening the possibility that enough additional gas might be found permitting the commercialization of the Aphrodite deposit without the need to add Israeli gas from the Leviathan deposit into the bargain. Specifically, an ExxonMobil chartered vessel did begin activities in Block 10, which lies to the southwest of the island.

The Turkish navy has not impeded those activities, although it did prevent Eni vessels from entering blocks to the east of the island earlier this year. Turkey has announced that its own drilling ship will enter the East Mediterranean in the near future, but has given no details on plans. The Turkish state company TPAO already carried out exploratory drilling in 2012 for oil and gas onshore in northern Cyprus despite protests from the Nicosia government.

Yet even if additional deposits are found off Cyprus, such that even Israeli gas is not necessary to commercialize them, still the expense will be too great for their transmission to Europe. And if they will be transmitted to Egypt for liquefaction, there is no reason why Israeli resources should not or could not be included. But there remains no feasibility, no financial backing, and no identified buyers for the product. Therefore any continuing discussions about the EastMed and/or CrossMed pipelines must be seen as only political atmospherics designed to prevent the idea from dying altogether by creating momentum for, at least, a three-way intergovernmental (Cyprus, Greece, Israel) agreement.

By contrast, following the visit of the Cyprus foreign minister to Egypt, it is likely that a bilateral intergovernmental agreement concerning a direct undersea pipeline is likely to be agreed in the near future. The two states agreed to the delimitation of their respective exclusive economic zones in 2003.

It is worth noting that the Turkish Cypriot leader Mustafa Akıncı and President Nicos Anastasiades of Cyprus met in mid-April 2018 for the first time since the last round of talks failed in summer last year in Switzerland. There has been no change in the two sides’ respective positions.

Akıncı made no substantive public comments, but Anastasiades said that Akıncı had raised the possibility of a joint committee for natural resource development and management: to which, Anastasiades said he answered, that neither this idea nor the postponement of Nicosia’s energy program would be discussed in negotiations. That is in line with earlier comments by the Greek Cypriot side, to the effect that intercommunal issues about resource questions would be settled only in the framework of the presumably federal state that would emerge from reunification.

To summarize, the prospect for a sub-sea Cyprus-Egypt pipeline for gas liquefaction and world export is the only possibility for resource development that seems to have progressed in recent months. The East Mediterranean energy province remains one that is more of promise than fulfillment.

Photo: “Eastern Mediterranean basins” (2013), by the U.S. Energy Information Administration via Wikimedia Commons. Public Domain.

Disclaimer: Any views or opinions expressed in articles are solely those of the authors and do not necessarily represent the views of the NATO Association of Canada.