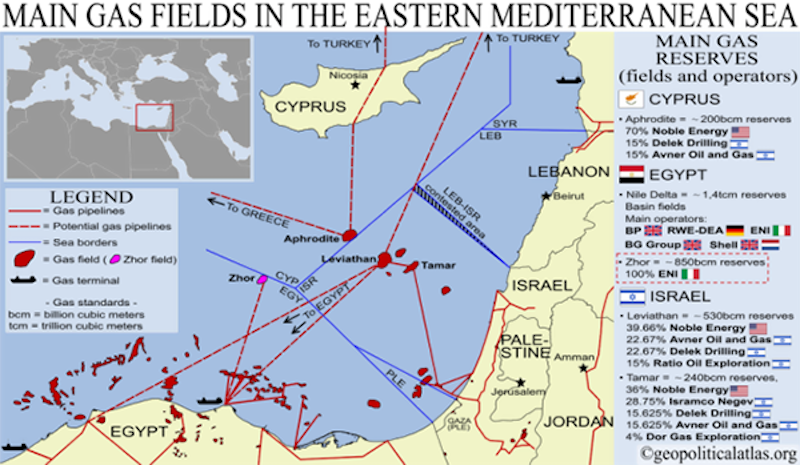

The Arab Spring threw a wrench into Egypt’s promising liquified natural gas (LNG) industry. Now, with stability returned to that country and the discovery of new gas deposits in the Nile littoral, Egypt is poised to become a major source of energy to the E.U. market. As auspicious as this sounds, it raises the stakes in an already volatile region marked by militarization and beset by inter-state strife and transcontinental tension.

Author: Cyril Widdershoven

Cyril Widdershoven is Founder and Director of VEROCY, a strategic foresight and development gateway for asset and resource value-management, and new international investments, in the Middle East and North Africa (MENA). A Middle East specialist in geopolitics, he focuses on energy, sovereign wealth funds, defence and geopolitical developments across the whole area. He has been heavily involved in MENA oil and gas sectors throughout his career. He has been principal consultant at Capgemini Consulting, senior manager for oil and gas at Deloitte Financial Advisory Services and manager of the oil and gas department in the equity and bond markets division at Financiele Diensten Amsterdam. He has lived and worked in Egypt, Lebanon, Jordan, Sudan, Iraq and the UAE, and also taken on extended projects for clients in Oman, Iran, Syria, Tunisia and Turkey.

Energy Conflicts Threaten The East Mediterranean

The continuing news about the Syrian Civil War tends to obscure the emergence of the East Mediterranean basin as a potentially significant energy-producing region, where military clashes in coming months cannot be ruled out. Recent energy-related success stories in the region include Egypt’s offshore gas discoveries and the continuing growth of Israel’s offshore gas projects, Read More…