On Tuesday it was announced that a historic deal had been reached in the Iran Nuclear Talks, inviting intense debate over its possible effects on the wider political environment. The major western powers long suspected Iran’s nuclear enrichment and technology programs were aimed at developing nuclear weapons and the so-called ‘P5+one’, referring to the five permanent members of the Security Council plus Germany, have been meeting with Iran for months in talks aimed at resolving the dispute. With Iran’s economy crippled by sanctions, its bargaining position stipulated their immediate lifting in exchange for long-term, verifiable curbs on its nuclear programs. As the fourth largest producer in OPEC, the lifting of Iran’s oil embargo is expected to extend cheap oil prices well into 2016.

P5+1 Ministers and Iranian Foreign Minister, Vienna 2014

The sanctions curtailed Iran’s oil exports by more than a million barrels a day(mbd) and resulted in approximately US $120 billion loss in oil revenue. The price of oil fell by over 45% in the last year and many expect a continued decline with Iran now allowed to re-enter an already over saturated market. At the same time investors are showing concern over China’s economy, with a stock market slide that could lessen the demand for oil that has been predicted. While there are many contributing factors to the price of oil, it is primarily a supply-and-demand industry, and the potential of Iran’s vast supply will be the focus in the coming days and months.

Iran has an estimated 158 billion barrels of oil reserves and the second largest reserves of natural gas in the world. Much of its resources have yet to be developed. However the lifting of sanctions could have immediate impact on the oil market as anywhere from 30 to 45 million barrels are stored in Iran’s idle tankers. Iran will sell as much of its oil as possible at any price, causing the market to flood and oil prices to plummet further. A senior analyst at the International Energy Agency expects “Iran to quickly return to the OPEC fold, very much as Iraq has done, increasing supplies as they please in an effort to claw back market share.’

World Oil Reserves

With the market already oversupplied by 1.5 to 2 million barrels a day, the resolution in the nuclear deal will be bearish for oil markets. Saudi Arabia and OPEC have been pumping record amounts following the oil price plunge over the last year and Iran is counting on OPEC to make way for its increased exports. Mehdi Asali, in charge of OPEC affairs at the Iranian ministry of oil stated, “those countries that have held Iran’s share of the market should reduce their outputs in order to make the market remain balanced.” While the Iranian government does not allow foreign ownership of its oil reserves, the possibility of reform has peaked the interest of investors. Currently foreign companies are paid for production but cannot book the reserves. However, reports detail several major oil companies, including Royal Dutch Shell Plc and Italy’s Eni SpA, visiting Tehran in May and June to discuss opportunities.

The predictions and fears over Iran’s impact on the oil market can be argued as exaggerated, when taking into account the fact that about half of the country’s oil production comes from fields more than 70 years old. Iran’s oilfields are in desperate need of repair in order to increase production and it would take more than two years to deploy the enhanced oil recovery (EOR) technology necessary for the damaged reservoirs. Even then, there is no guarantee that these costly measures will increase production, rather it may only succeed in limiting the fast depletion of its oilfields. It is also estimated that of the 40 million barrels stored in floating terminals, 21 million of the barrels are condensates, an ultralight blend of oil that may not be the most sought-after crude in Asia.

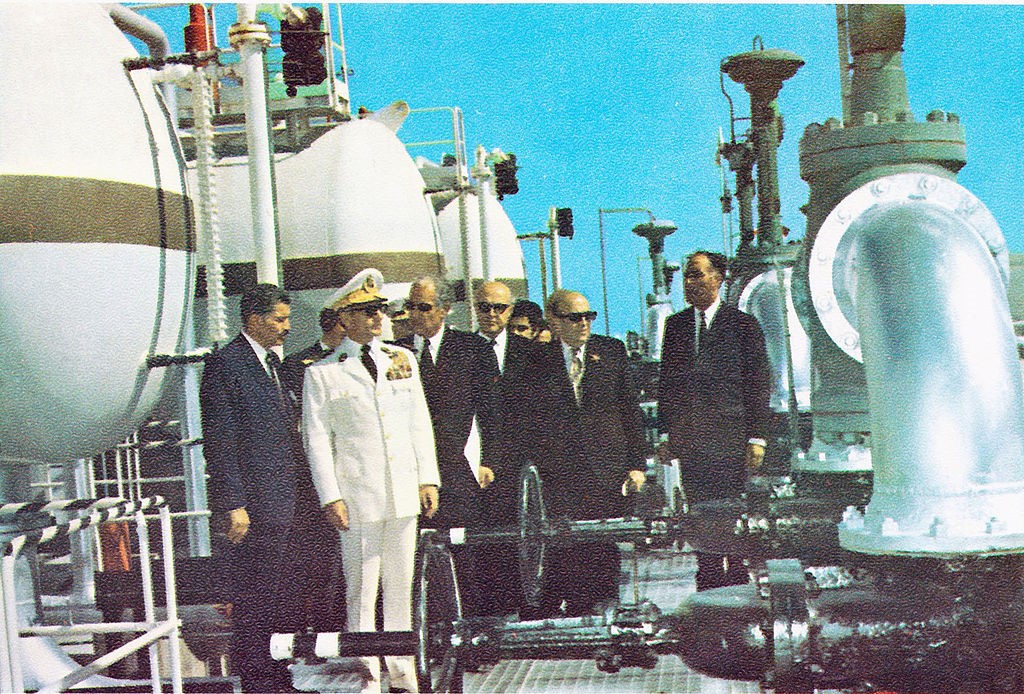

The Shah opens the facilities of International Naval Oil Company of Iran, 1970

The Shah opens the facilities of International Naval Oil Company of Iran, 1970

For international oil companies interested in investment there is a strong element of risk given the possibility of sanctions returning, should Iran’s actions conflict with the terms of the agreement. U.S. companies are still barred from doing business with Iran, while Non-American companies have more freedoms, provided they don’t use U.S. technology or personnel. The oil and gas companies returning to or entering Iran in the wake of a deal will face a broad range of political and regulatory challenges, from an inefficient petroleum bureaucracy to heightened regional tensions.

If Iran were to return to pre-sanction levels of output it would likely add about 500,000 barrels a day, not a significant number when compared to the 90 million barrel daily oil market. The additional supply of oil into the market would knock roughly $5 a barrel off the expectations for prices in 2016, amounting to less than one quarter of a standard deviation. There are other factors in future oil prices which could have a more significant impact, such as uncertainty in Greece and China, changes in global GDP or the return of Libyan oil.