Energy independence has long been an objective of the United States government. In recent years, the shale gas revolution has propelled the Obama administration toward attaining energy self-sufficiency. Recent figures supplied by the International Energy Agency in September 2014 affirm that U.S. production of liquid petroleum has reached 11.5 million barrels per day. On its present course the U.S. is set to outpace Saudi Arabia’s 11.6 million barrels in the coming months.

Energy independence has long been an objective of the United States government. In recent years, the shale gas revolution has propelled the Obama administration toward attaining energy self-sufficiency. Recent figures supplied by the International Energy Agency in September 2014 affirm that U.S. production of liquid petroleum has reached 11.5 million barrels per day. On its present course the U.S. is set to outpace Saudi Arabia’s 11.6 million barrels in the coming months.

The U.S. shale oil surge began in 2008 and has since increased U.S. crude output by 60%. However, the American crude oil economy is still well behind the production figures set by Russia which is leading the race with 10.1 million barrels per day and Saudi Arabia who is close behind with 9.7 million barrels per day. Current figures from crude oil drilling in North Dakota and Texas sit at 8.5 million barrels per day, its highest level since 1986.

Analysts have speculated on what effect the United States’ rise within the energy market will have on oil prices. On the domestic front the U.S. economy will benefit from importing less foreign oil. This will reduce and balance their trade deficit and create capital that can be reinvested into energy sector development.

From an international perspective, if the U.S. eliminated the barriers to trade it has imposed since the 1973 Arab oil embargo, it could significantly strengthen its domestic economy. The oil export ban was imposed as a result of the Energy Policy and Conservation Act of 1975. This legislation prohibited the export of U.S. oil unless the president determined that certain exports are in the national interest. Allowing the export of U.S. oil would only benefit the domestic economy if the energy sector maintained enough oil reserve resources to guarantee long-term self-sufficiency. A Brookings Institute study found that increasing U.S. crude oil exports would positively affect both the U.S. and international oil markets. The study forecasts that U.S. GDP would rise between U.S. $600 billion and U.S. $1.8 trillion from 2015 through to 2039 if the ban were lifted.

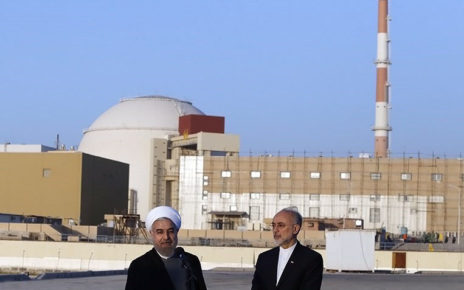

Experts believe the adoption of a strong U.S. oil export market would also prove beneficial to U.S. interests by inflicting economic and political damage upon Russia, Iran and other members of OPEC. An influx of supply within the international market would deflate oil prices. A decrease in pricing will severely impact nations such as Russia, where crude oil and oil products made up 46% of the country’s revenues for the first 8 months of 2014. Iran would likely feel the pricing pinch as well. Their oil exports are already limited through international trade sanctions. Iran’s oil minister called on OPEC members to keep oil prices from falling further by offsetting their production to avoid further price instability.

Looking into the future Adam Sieminski, administrator of the federal Energy Information Administration, is convinced oil consumption will climb 38% between 2010 and 2040 based on growth outside of OECD countries. If a balance between consumption and supply is not achieved then consumers could be paying for it at the pump. The U.S. position toward the international oil export market, given the influence they yield, will profoundly influence the race toward global energy supremacy. Ryan Krueger