I have argued on this blog before that Canada’s Commonwealth ties are an untapped resource with enormous potential for economic growth, cultural development, and strategic partnership. Nowadays it seems that most Commonwealth countries stand out as islands of good sense, financial prudence, and economic growth amidst a sea of international financial ruin and mismanagement. But will the idea of a Commonwealth revival catch on?

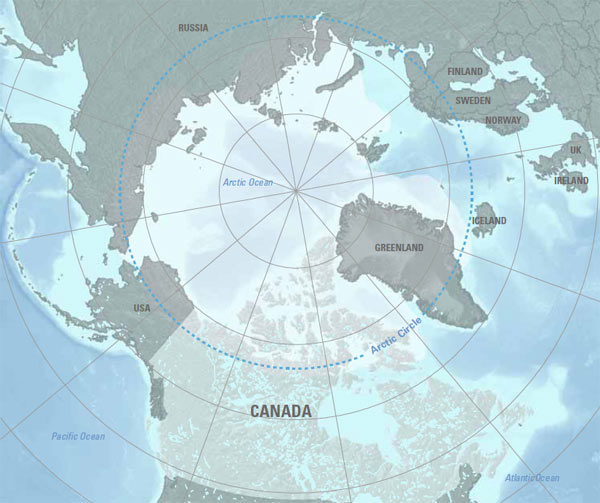

It seems that it could. Or at least it is more credible now than it was even a month ago. Tim Hewish and James Styles, two parliamentary researchers at the UK parliament Westminster, have just published a 113-page investigation into freer trade, growth, and prosperity across the Commonwealth. It is entitled Common-trade, Common-growth, Common-wealth, and is available for sale here. Of course, the pamphlet is written from a British perspective and is directed mainly at British MPs, but it will certainly be grist to the mill for entrepreneurs and business people also. And there is much that we Canadians can reflect on too.[captionpix align=”left” theme=”elegant” width=”320″ imgsrc=”http://atlas.nrcan.gc.ca/auth/english/maps/reference/international/commonwealth/map.jpg ” captiontext=”An intergovernmental organization comprised of 54 member states, the Commonwealth is spread all over the globe, and represents every major religion and language, though English is its lingua franca. Canada is a founding member of the Commonwealth.”]

Common-trade, Common-growth, Common-wealth presents some surprising findings. Combined Commonwealth GDP stands at $8.4 trillion and projected annual total growth is 3.7%. In African and Asian Commonwealth countries, growth is even higher at 5.0% and 6.5% respectively. The size of the work force in Commonwealth countries is forecast to increase by 60% by the year 2050. Compare this to Europe where the work force is expected to shrink by 54 million in the same period of time. Commonwealth countries consistently rank high (much higher than European countries) on measures such as the Fraser Institute’s Indexes of Freedom, the Corruption Perception Index, and the World Bank’s Ease of Doing Business rankings. And according to a JP Morgan Asset Management study quoted in the pamphlet, a monetary union made up of the UK and other English-speaking countries would be the second most viable and sustainable economic zone in the world. First place went to a hypothetical Latin American Union. The Eurozone, however, came in dead last behind a random sample of all countries whose names begin with the letter ‘M’.

The pamphlet also focuses special attention on Commonwealth countries in Africa. 14 of the 16 African countries that have a functioning stock market are in the Commonwealth. Similarly, 9 of the 15 African countries that have obtained credit ratings are in the Commonwealth. These findings are likely to put paid to the idea of BRICS-only emerging economies. In fact, they call into question putting any special emphasis on the BRICS countries at all.

The pamphlet clearly proves that the Commonwealth would be an excellent place for all countries involved to do business. This much would be clear to anyone who looked into all the relevant statistics and studies in isolation. That Hewish and Styles have gathered them all together means that the case for Commonwealth business and trade will probably not need to be restated.

Hewish and Styles’ most important contribution to discussion of the merits of Commonwealth trade is that they outline a series of recommendations designed to facilitate it. Amongst many suggestions, a Commonwealth investment and development bank and a Commonwealth stock exchange are perhaps the most interesting ones put forward.

Ideally, the hypothetical Commonwealth Investment and Development Bank (CIBD) would grow out of, or replace, the already-existing Commonwealth Fund for Technical Cooperation (CFTC). This fund currently has a mere £30 million pounds to distribute each year, which is nowhere near adequate for the large scale trade and infrastructure projects envisioned for it by Hewish and Styles. So this would have to change. Moreover, the CIBD would not operate along the lines of the World Bank or the European Investment Bank: all investments granted by the CIDB would have to be pitched by private enterprise — not by governments.

The idea of a Commonwealth Investment and Development Bank may seem far-fetched, but it isn’t. The BRICS countries have been seriously considering the establishment of their own alternative to the World Bank. If they can do it, why can’t the Commonwealth? Two of the BRICS countries (India and South Africa) are, of course, in the Commonwealth. One would think, though, that it would be much easier for them to work with other countries who shared their values rather than highly authoritarian Russia and China.[captionpix align=”right” theme=”elegant” width=”320″ imgsrc=”http://vernoncorea.files.wordpress.com/2012/08/commonwealth-flag.gif ” captiontext=”The Commonwealth flag at present.”]

A Commonwealth stock exchange is a far more radical proposal. But it has great merit. The idea was first mooted by Andrew Monk, CEO of VSA Capital who called for a merger of the LSE, TSX, ASX, JSE, and SGX. Hewish and Styles ran the numbers and discovered that a linked exchange of African, Asian, European, and North American and Australasian Commonwealth companies would constitute a $10.6 trillion market of publicly-traded shares. This would make it the second-largest such market in the world after the NYSE.

Perhaps the greatest virtue of this proposed stock exchange is that it would arise as a result of a need to fill a gap in the market, not because of political machinations. But it would also provide legitimacy and market-access to the 13 African Commonwealth countries that have stock exchanges. This would allow those countries to trade with more advanced economies on a level of equality — a large step towards breaking the grim cycle of dependency on government aid.

There are, of course, other recommendations. These include a Commonwealth website hub, a ‘Made in the Commonwealth’ brand, and a Commonwealth business visa — all of which have high potential for encouraging trade.

Where does Canada fit in, and what should we do? Canada is a founding member of the Commonwealth, and is its oldest member state after Great Britain. We would therefore be at the centre of whatever processes lead to the revival of the Commonwealth, and we would of course be in a good position to influence them. In fact, so far Canada has led the way by appointing Senator Hugh Segal as Special Envoy for Commonwealth renewal. No other country has created a similar position.

Our first task should be to encourage our government to study Hewish and Styles’ specific proposals such at the CIDB and the Commonwealth stock exchange. Such ideas are surely not without problems (the failed merger of the Toronto and London stock exchanges in 2011 may be a case in point), but formal investigation and public awareness of them must be the first step forward. I hope this brief article may help to instigate discussion of Hewish and Styles’ ideas.

In a world of increasing political risk and uncertain economic future, having friendly partners with whom to trade freely will be highly beneficial to Canada. Most of the necessary groundwork is already in place in Canada’s fellow Commonwealth countries, and we should look to them first.