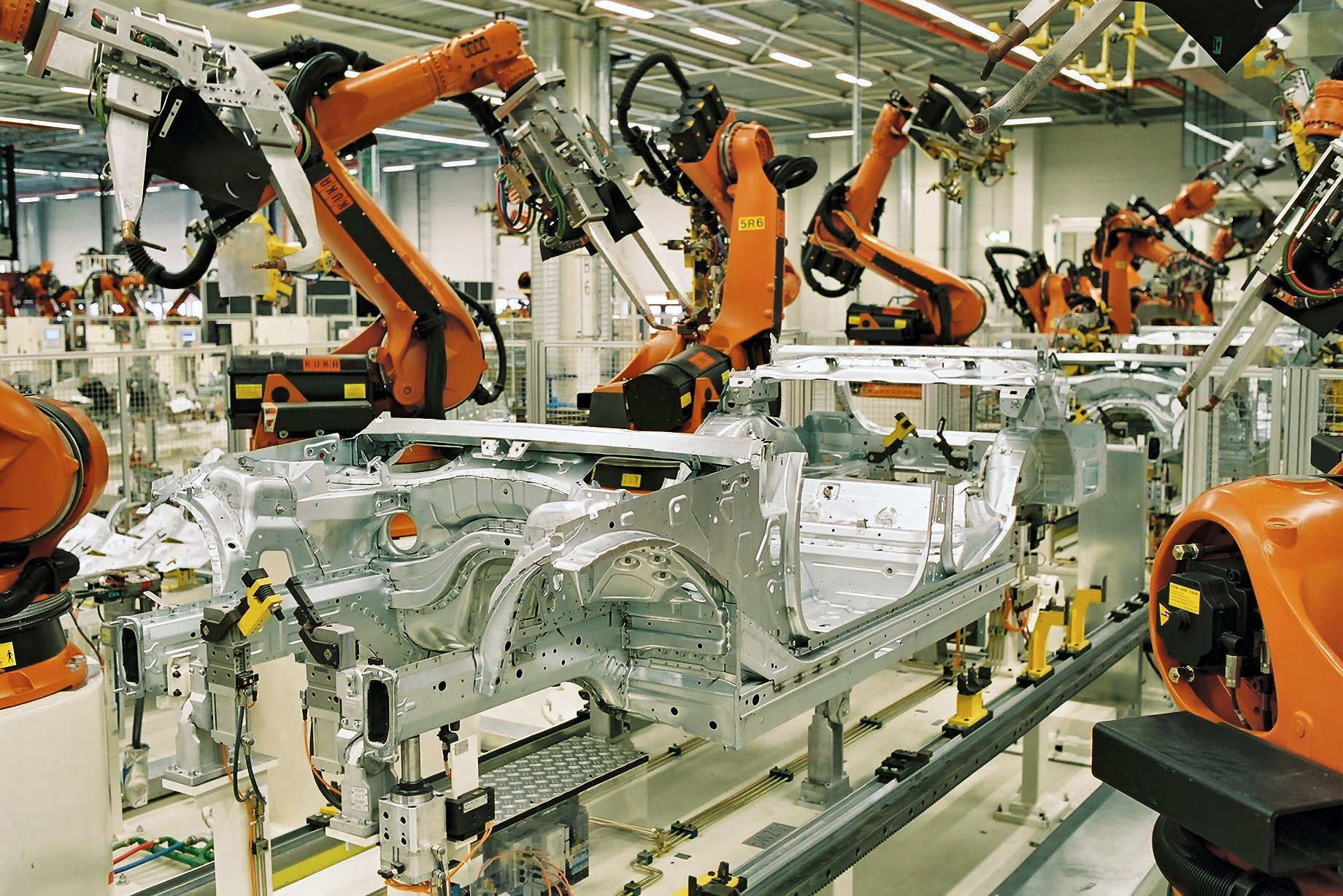

Although a strong advocate for Free Trade, and participant in over a dozen free trade agreements with regions around the world, Canada’s trade policy is not entirely open. A wide variety of goods from around the world have tariffs on them as high as 20%, in addition to up to 15% in tax, depending on the province. In 2009 the Canadian government committed to eliminate tariffs on manufactured inputs and machinery by 2015 which will greatly benefit manufacturers. However, as the government pursues additional trade agreements with various nations, more can be done to open free trade to benefit Canadian consumers, businesses and the government.

In a 2013 letter to then Minister of Finance, Jim Flaherty and Minister of International Trade, Ed Fast, several of Canada’s largest industry and importer associations advocate for a higher de minimis threshold. The de minimis is the value of goods that can be imported before duties are imposed. In Canada, the level is $20 CAN, which applies to both personal and commercial imports. Currently, travellers crossing the border have a higher threshold, with an allowance of $200 CAN for a 24 hour stay and up to $800 CAN after 48 hours. Canada’s $20 limit is one of the harshest among its peers. The U.S, UK, Germany and France thresholds are $200 USD, while some nations like Australia have a limit as high as $900 USD.

At a level of $20 CAN, the threshold for import value before duties is too low and outdated given the pace of globalization.

Canada’s low exemption, unchanged since 1985, stifles international trade and harms Canadian consumers and SMEs alike. Under NAFTA, goods made in the U.S. are exempt from tariffs; however, goods imported from the U.S. that were made elsewhere are still subject to duties. Small businesses that rely on high volume trade, a trend that has been growing due to e-commerce and the low cost of shipping, are discouraged by the high fees. Advocates for small online retailers, such as Ebay, suggest that the de minimis would be more appropriate at a level equal to the U.S, $200.

If the de minimis level were raised, consumers would benefit from the better prices, larger variety and more flexibility of online shopping. Some of the price discrepancy between the U.S. and Canada can be attributed to the high tariffs faced by importing retailers, and a higher de minimis would help equalize the retail market.

Finally, the administrative cost of implementing duties would decrease due to a lower volume of goods being assessed. A report by Ebay suggests that raising the de minimis to $200 could save the Canadian Border Services Agency more money than they receive applying duties to shipments under that level.

At a level of $20 CAN, the threshold for import value before duties is too low and outdated given the pace of globalization. Even a slightly higher threshold would have a positive impact on small businesses, consumers, and even on retailers who pass on their high import costs to consumers. In addition to pursuing new trade agreements, the Canadian government needs to re-examine its customs policy to bring it in line with the current global economic realities.