In recent years, Germany has cultivated a reputation as a solitary economic success story in a volatile era of crisis and slow recovery. Certain other countries weathered the crisis better than most, but none hold an economic significance close to that of Germany. These years have seen German officials take on a heightened prominence as their country’s political power became more thoroughly established. Despite its successes, there have been some tensions between Germany and its partners. Some citizens of Germany’s Mediterranean neighbours have expressed trepidation or outright hostility toward Germany’s increased influence, but there has also been a less publicized divide between Germany and the United States.

On January 8, US Treasury Secretary Jack Lew visited Germany to advocate a shift in German economic policies aimed at increasing domestic demand and lowering the country’s trade surplus. The US fears that a perpetuation of European trade imbalances, however beneficial for Germany in the short term, threatens to undermine the European economy as a whole, effectively weakening the global economy as a whole.

Implicit in this American endeavour is some recognition of the true source of Europe’s economic problems. Some economists have been pointing to Germany’s persistent export surpluses as the source of the Eurozone crisis for some time now. Others have been happy to accept a specious media narrative which vastly overemphasizes and overstates the supposed profligacy of Mediterranean governments as the cause of Europe’s difficulties. Germany’s massive export surpluses are not a consequence of the Eurozone crisis, they predate its arrival. Instead, the imbalance between current accounts in Germany and its neighbours can more reasonably be labelled as a cause. In other words, the sovereign debt crisis was more fundamentally an international trade crisis. Admittedly, the structural imbalances that have been built into monetary union and exploited by its strongest economies are more difficult to explain to a broad audience than simply labelling certain governments as spendthrifts. However, with the US becoming more strident in its efforts to entice a German change of course, the importance of intra-European trade may become increasingly difficult to ignore.

The US views Germany’s export-driven model as anti-inflationary, driving up the value of the Euro, preventing peripheral Eurozone economies from effectively stimulating their own relatively weak export sectors. Traditionally, as countries become heavily indebted, they experience inflation which decreases the value of their currency, undermining consumer capacity at home, stimulating exports, and ameliorating their indebtedness. In the Eurozone, however, if Germany prevents inflation, their indebted neighbours cannot experience this process since they share a currency and do not have the economic clout to provide a sufficient countervailing inflationary force.

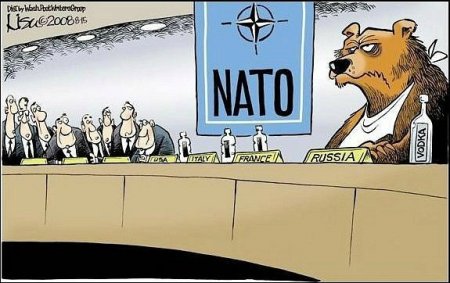

Presented with this set of circumstances, some feared that Germany would establish itself as an increasingly hegemonic power operating under the premise that what is good for Germany is good for Europe. But an alternative scenario is beginning to emerge in which the United States exerts its influence to bring a semblance of balance to the Eurozone. This is being done out of concern for the global economy rather than a sense that peripheral European states are being treated unfairly, but they may reap some benefit from America’s involvement nonetheless. The US would like to see Germany stimulate domestic demand as a means of rebalancing their balance of trade. Germany has been resistant to the US’ suggestions thus far.

Right now the US is in a difficult position in which it feels compelled to object to what it sees as troubling German policies, without any believable recourse beyond its strenuous objections. The health of the German economy is vital to the global economy, so it is difficult to incentivize German policymakers to change an approach that has proven remarkably effective for their economy thus far.

It is difficult to avoid deriving some geopolitical meaning from this current impasse. First, it reinforces the suspicions of many that European Monetary Union has failed to facilitate comprehensive unity, but instead precipitated new international divisions. Additionally, the US’ relatively ineffectual role at this moment seems to bolster arguments that US influence has waned in recent years. Perhaps most importantly, this is a clear case of western governments preferring entirely divergent approaches to a major economic issue. This has been a rarity over recent years, when western consensus on these matters could almost be taken for granted. Whether or not this international division intensifies over time remains to be seen, but despite the apparent calming of the economic crisis, its political implications continue to unfold.