Oil prices have dropped to a 6 year low and no direct resolution is imminent. The Bank of Canada recently cut the benchmark interest rate to provide “insurance” against the low oil prices. The happy Canadians are the ones who have been ignoring the news and experiencing the satisfaction of purchasing cheaper gas. Multiple sources predict the price of oil to rise again in the next year or so, but, no one can know for sure. What does this mean to Canadians living in different regions and working in different sectors?

Cheaper oil means cheaper gas at the pumps. It also means lower prices for things like electricity, transportation and heating. Canadian companies, not just consumers, face these lowered input costs as well. Currency tends to move with oil prices, and BMO recently estimated that every 10 dollar movement in the price of oil equals a three-cent move in the loonie. A lower Canadian dollar can stimulate the economy through greater spending by consumers.

Demand for oil is low because of weak economic activity and supply is extremely high. The economic growth of nations consuming oil is going to benefit at the expense of oil-producing nations. Canada is an oil producing nation, but only few provinces rely on this as sources of GDP. Provinces that collect oil royalties – including Alberta, Saskatchewan and Newfoundland and Labrador, will be hit the hardest.

The revenue loss will cut deeply into Canada’s business investment in energy-related industries. Large companies have been pulling back their investment plans. In Alberta, real GDP growth is expected to fall by almost 50% from 2014. The oil sector, which is a large revenue generating factor for the economy, could be down around 35%. The impact restrains housing activity in places like Alberta, and provides incentives for households whose incomes rely on the oil sector to build their savings.

Canadian manufacturers and exporters are likely to see a boost in demand thanks to growth in the U.S. and a lower Canadian loonie. Global auto sales have already been on the rise in recent months and are expected to keep increasing. Drivers of a Honda Civic, for example, are saving $15 when filling an empty tank.

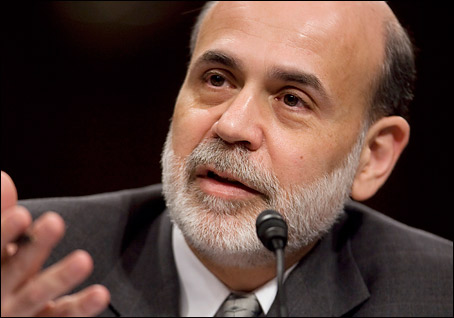

Recently, the Bank of Canada Governor Stephen Poloz cut the central bank’s overnight rate to 0.75 per cent from 1 per cent which influences lending rates across the economy. The bank recognized that “the oil price shock increases both downside risks to the inflation profile and financial stability risks.” Poloz said, “The Bank’s policy action is intended to provide insurance against these risks.” The impact of lower oil prices will gradually be mitigated by a stronger U.S. economy, a weaker Canadian dollar, and the bank’s monetary policy response.

Insurance against financial stability risks and inflation is the intention of the policy announced yesterday, but how it plays out is another story. Sal Guatieri, a senior economist at BMO Capital Markets in Toronto, said, “It is an aggressive move. It speaks volumes about where the Bank of Canada sees the economy and inflation going.”